Consumer confidence

House Prices

Sterling

Wages/employment/inflation

GDP

Theresa May is under huge pressure as she fights to cling on to power (Jack Hill – WPA Pool/Getty Images)

Theresa May promised the deliver a “strong and stable” government and warned against a “coalition of chaos”.

But after the shock showing of Jeremy Corbyn’s Labour party in the general election, it is the Prime Minister who is now being mocked as weak and wobbly.

The events of polling night just three weeks ago, coupled with the on-going fallout from Brexit a year ago, has left the British economy and consumers feeling decidedly fragile.

Here are some of the key indicators of the economy which are perhaps not as “strong and stable” as they once were.

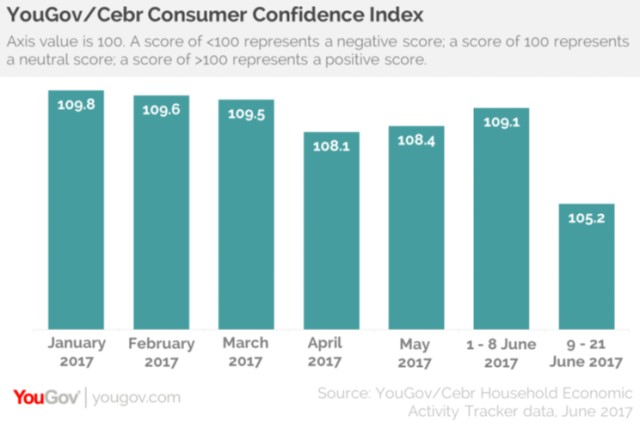

Consumer confidence

The messy general election which saw Theresa May’s Conservative Party cling to power with her majority wiped out, has hit already wobbling consumer confidence.

Research by polling firm YouGov and consultancy CEBR shows confidence fell back to just above levels last seen just after last year’s shock referendum decision to leave the European Union.

“The real cause for alarm will be the cooling of the property market, as this is one of the key things that has propped up consumer confidence over the past few years,” Stephen Harmston, head of YouGov Reports, said.

Douglas McWilliams, deputy chairman at the CEBR, added: “The data shows a sharp drop in consumers’ confidence about their own financial situation and even more so about house prices. This will affect spending in the high street, in shopping centres and online.”

House prices

Britain’s love affair with bricks and mortar has been an intense relationship but there are signs the ardour is beginning to cool.

According to Nationwide, the UK’s biggest building society, house prices fell for the third month in a row in May. While the year-on-year rate continues to rise – up about 2.1% – its monthly house price index showed that the average price of a home fell by 0.2% between April and May, to £208,711. This compares with monthly declines of 0.4% in April and 0.3% in March.

House price rises continue to slide (Source: Nationwide)

Further evidence on the uncertainty created by the general election comes from NAEA Propertymark (National Association of Estate Agents), which reports only 3% of properties sold for more than asking price in May, down four percentage points in April and the lowest level since October.

The number of homes which sold for less than asking price rose to 77% last month – up five percentage points from April.

That said, many still believe the housing market is still wildly overpriced and out of reach for millions.

Sterling

The pound has seen a seismic fall in value since the referendum. Just before last year’s vote £1 would buy $1.47 – today it is trading around $1.28. It is a similar story against the euro, where it stood at €1.30, but now commands just €1.13.

It’s a mixed picture for Britons, however. The falling value of sterling has seen the cost of holidays abroad leap, while more expensive imported goods and foods have also pushed up supermarket prices.

A graph charting the falling value of sterling against the dollar (Yahoo Finance UK)

But, for exporters, British goods are now more affordable. Many commentators have welcomed sterling’s fall, saying that the pound had been overvalued for some time.

Wages/employment/inflation

While there are record levels of employment, British workers are in the middle of the longest slump in real wage growth for a decade.

Official figures show the employment rate reached almost 75% in the first quarter of the year, while the unemployment rate stood at 4.6%, or 1.54 million, the lowest since 1975.

Average weekly earnings total pay – real and nominal (Source: ONS)

However, the latest official figures show workers will still be earning less in 2021 in real terms than they did in 2008, before the crash.

Inflation hit its highest level for nearly four years in May at 2.9%, tightening the squeeze on consumers already struggling because of low wage growth. In the first three months of this year, wages fell by 0.2%.

GDP

Britain’s poor recovery from the financial crash of 2008 has left it trailing behind other members of the G7 group of leading industrialised nations.

According to the Office for National Statistics, the UK was 16% behind the likes of Germany, the US and France in terms of output per hour for 2015, the last year for which data is available.

Gross domestic product per hour worked, G7 countries, 2014 and 2015 (Source: OECD/Eurostat/ONS)

The only G7 countries with weaker productivity than the UK are Japan and Canada, the ONS said.

That malaise has continued following last summer’s Brexit vote and the snap general election.

The respected Organisation for Economic Cooperation and Development earlier this month cut its forecast for growth in the UK economy from 1.8% to 1.6% this year, dropping to just 1% in 2018.

The ONS said GDP grew by 0.2% in the first quarter of 2017, revising down the figure from its initial estimate of 0.3%.

The services sector put downward pressure on GDP after output for the industry was revised down to 0.2% from 0.3% for the first quarter.